Eric Hartline-USA TODAY Sports

By now, you’ve probably heard that Shohei Ohtani’s $700 million contract will pay him through 2043, with Ohtani deferring an unprecedented $680 million (over 97% of his contract). The structure calls for Ohtani to earn just $2 million each year of the contract, and then $68 million a year for the 10 years following the deal.

Ohtani will inarguably be taking home $700 million via this deal, and I disagree with the notion that the contract should be described as anything other than that big number from a bottom-line perspective. But what matters, especially with regards to the Competitive Balance Tax (CBT), is the present value of the contract.

Article XXIII of the CBA concerns the CBT, and the key component for determining payrolls for CBT purposes is the average annual value (AAV) of contracts. If Ohtani’s contract didn’t contain any deferrals, his AAV would be $70 million, calculated by simply dividing $700 million by the 10 years of his contract. Where things get complicated is with deferrals. When money is deferred in a contract, the value of that money depreciates over time, and it is the depreciated value of the contract that is used as the numerator, or replacement for the $700 million, in the AAV calculation. Ohtani’s deferrals will be paid without interest, which is key for depreciating the value of the payment; interest would have increased the present value of the contract, and as such, the AAV and corresponding CBT hit.

So, how is the AAV calculated? The key numbers here are $68 million, 10, and 4.43%. The $68 million is the money deferred each year. The 10 refers to how many years each contract year is deferred for (i.e., year one gets deferred 10 years to year 11, year two gets deferred 10 years to year 12, etc.). The 4.43% is the yearly discount rate, which is the Imputed Loan Interest Rate (ILIR) referred to in Article XXIII(6)(c). The ILIR is synonymous with the federal midterm rate, and the CBA calls for using the federal midterm rate reported by Internal Revenue Service for the October prior to the contract year (i.e., October 2023 in this case); since we have no ILIR data beyond October 2023, the league uses that rate for the entirety of the contract. The 4.43% is a yearly rate, which as such is applied to each successive year, or put another way, 10 times.

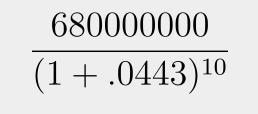

This leaves the overall formula for the value of the $68 million deferred each year as:

That outputs a value of $44,081,476.50. The final step is to add back the $2 million paid each year that is not subject to a discount, giving us a final value of $46,081,476.50, which applies to the CBT each year, and an overall present value for the whole contract of $460,814,764.97. That $46 million(ish) hit to the CBT still sets a contractual record, beating the $43,333,333 that Max Scherzer and Justin Verlander’s shorter-term contracts called for, but not to the cartoonish degree that $70 million would have.

Deferrals are not uncommon; famously, Bobby Bonilla and his representatives deferred $5.9 million of his Mets contract upon his release in 1999, converting it into a $1.19 million payment every July 1 from 2011 to 2035, with the negotiated interest bringing his total payout to $29.8 million. Deferrals without interest are more common these days; Scherzer’s Nationals contract deferred half of his salary and brought the present value down from $210 million to $185 million. Current Dodgers Mookie Betts and Freddie Freeman also have large chunks of their contracts deferred, but no contract has ever been deferred to anywhere near this degree. (With Ohtani now in the fold, the Dodgers owe the trio a combined $852 million in deferrals.) While the CBA explicitly states that there are no limits on how much of a contract can be deferred or for how long, Lindsey Adler and Richard Rubin of the Wall Street Journal report that MLB has proposed limits in the past, but the union has thus far rejected those overtures. Adler and Rubin’s article also includes some further detail on how Ohtani’s income tax filing will be affected by the deferrals; Rob Mains of Baseball Prospectus also considered the tax implications in his analysis this morning.

Amazingly, the deferrals mean that, as of now, the Dodgers’ 2024 luxury tax payroll is just under $220 million, a figure that is still $17 million below the first tax line and $57 million below the threshold that would force their first draft pick back 10 spots if crossed. Having the flexibility to continue to add talent to the roster was reportedly a significant motivator for Ohtani when he and his representatives broached this contract structure with teams, with these sorts of massive deferrals factoring into all of their negotiations.

Source

https://blogs.fangraphs.com/shohei-ohani-is-deferring-97-of-his-contract/

Backyard GrillingWeekend WarriorsAdvice from DadBeard GroomingTV Shows for Guys4x4 Off-Road CarsMens FashionSports NewsAncient Archeology World NewsPrivacy PolicyTerms And Conditions

Backyard GrillingWeekend WarriorsAdvice from DadBeard GroomingTV Shows for Guys4x4 Off-Road CarsMens FashionSports NewsAncient Archeology World NewsPrivacy PolicyTerms And Conditions