In 2019, St. Louis was riding high with an ownership group buying their way into the Major League Soccer league. The owners had even selected a piece of land for their soccer stadium that many others coveted. This would “serve as the centerpiece of a new real estate development” in downtown St. Louis. Most importantly, the ownership group claimed in interview after interview that the taxpayers would not be funding this entire project…just a bit of it.

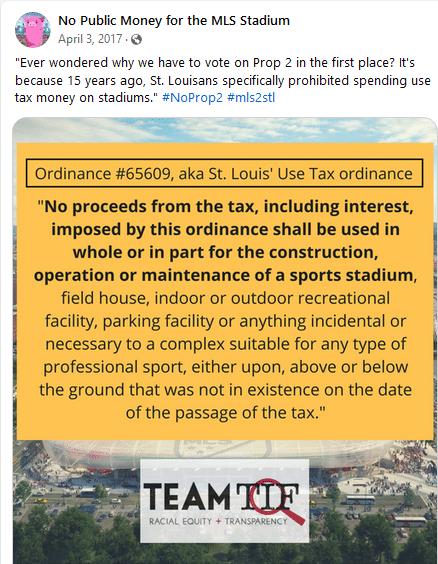

As the Mercatus Center noted in 2019, even though the owners continued to claim that the stadium would be “overwhelmingly” privately funded, city officials “admit(ted) that various tax exemptions are still on the table”.

— Facebook

Let’s talk about the stadium. As said in a local NPR story at the time, this ownership group was “financing the vast majority of the $500 million development, which includes the stadium, team offices and practice fields”. Specifically, the new stadium would “not require any direct citywide tax or tax increment financing”. When this ownership group was first announced, the leader told local press that the owners were willing to “pay for a $250 million downtown stadium in cash”. The owners even did town halls around the city where they claimed that they would pay for “all maintenance, operations, and upgrade costs” of the stadium.

To the ownership group’s credit, they are funding a large part of the deal. This is not the worst deal that I have seen for either the team or the city. But this idea that the ownership group is funding almost all of it? Please. Give me a break.

Before the stadium was even built, the city of St. Louis made the following promises to the team: 50 percent break on ticket taxes, full tax exemption on stadium construction materials, $30 million tax break from the state, the free use of land near the stadium, and a 3% sales tax on stadium goods. This ownership group was also collecting money from a number of other government places. For example, the Missouri Development Finance Board gave the team $5.7 million in state tax credits. This was after the team asked for $30 million!

— Facebook

As one River Front Times writer said in a story that was written before the owners got the $5.7 million in tax credits:

“Before Missouri provides…taxpayer funding, through…tax credits…we ought to consider four simple economic principles regarding the owners of our new MLS stadium:

1. They don’t need the taxpayers’ money to succeed with their investment

2. The taxpayers’ money is not necessary for their investment to succeed

3. Their investment does not require the use of taxpayers’ money to succeed

4. They. Don’t. Need. This. Money”

— RiverFrontTimes, 12/11/19

Then the ownership group wanted a little more off the top:

“As for maintaining the stadium, (city leaders previously told the public that only fans would be paying for it)…the ownership group wants to be exempt from half of the city’s 1 percent amusement tax with the other half going into a special escrow fund to pay for major improvements or possibly tearing the stadium down…some aldermen have told 5 On Your Side privately…concerns about there being enough money over time to fund any major upgrades or improvements needed to keep the stadium viable and competitive” — KSDK, 08/23/19

Maybe the public will be paying a bit more than previously promised? The public will still get that big amount every year for property taxes, right? No. The owners would be exempt from property taxes. Meaning, the local economy misses a “little over $1 million a year”.

— Facebook

But let’s talk about that last promise. KSDK did a good job of breaking down that sales tax promise:

“The stadium creates three new taxing districts: a stadium-specific community improvement district, a transportation development district and a port improvement district. Each district would be governed by a board, and the ownership group would have the right to put one person on each board. The new taxing districts would also levy a new 1 percent sales tax for infrastructure and construction” — KSDK, 08/23/19

Well, guess who is increasing the sales tax rate to almost 13%? If the city board approves a new sales tax district near the stadium, then the sales tax rate will increase ANOTHER 1% because the team was recently forced to pay “extraordinary costs” to fix the stadium field. The stadium land contained “contaminated groundwater” that was quite a pain to fix and replace.

To me, it appears that basic facts of this situation are still unanswered. First, the team claims to have numerous and expensive costs to fix the field. Yet, they have not been asked to detail any of the expenses. So the public has no clue what the exact costs were incurred by the team? Second, how much money would be made off the 1% sales tax increase? We don’t know. The team hasn’t released any details, nor has the city.

— BizJournals

This makes my head spin. I guess city leaders just looked at an email and said out loud “approve it” as their due diligence? Well, judging by a 2019 St. Louis Dispatch story on tax-increment financing district and transparency, that type of digging into a subject would frankly be about right for these city officials.

Keep in mind that the ownership group was promised by the city that they could levy three 1% additional sales tax districts to offset for stadium expenses. If this sales tax increase is agreed to by the city, then the team will now have the ability to levy two different 1% sales tax districts.

The post St. Louis MLS owners required no “direct taxes” in 2019…now they are increasing sales tax rate to 12.7% appeared first on Subsidy Stadium.

https://subsidystadium.com/2024/03/17/st-louis-mls-owners-required-no-direct-taxes-in-2019-now-they-are-increasing-sales-tax-rate-to-12-7/

Backyard GrillingWeekend WarriorsAdvice from DadBeard GroomingTV Shows for Guys4x4 Off-Road CarsMens FashionSports NewsAncient Archeology World NewsPrivacy PolicyTerms And Conditions

Backyard GrillingWeekend WarriorsAdvice from DadBeard GroomingTV Shows for Guys4x4 Off-Road CarsMens FashionSports NewsAncient Archeology World NewsPrivacy PolicyTerms And Conditions